Codex Genesis — Mapping the Rhythm of Bitcoin & Crypto Markets (2020–Now)

Five years of timestamped pivots, documented before consensus. (Intro + Case Study + Launch Preview)

Intro

Codex began on the Hive blockchain — five years of timestamped proof, published before price resolved.

This is the continuation.

Not a reset.

Not a rebrand.

The same rhythm.

The same structure.

The same voice — now archived on Substack.

“This isn’t hindsight. Codex VIII mapped the Bitcoin bounce on Nov 22, 2025.

The structure confirmed in December.

January so far is delivering it.

Now we prepare for the LH — the next major pivot Codex is tracking.”

Codex Brief is not commentary.

It is a market chronicle — a living archive of rhythm, structure, and macro pivots documented before consensus.

Most services describe what happened.

Codex documents what is already unfolding.

I. Why Codex Exists

The last five years confirmed one thing:

The market is not chaos.

It is rhythm.

Not perfect.

Not stable.

Not constant.

But rhythmic.

Codex documents that rhythm — a framework to observe how price moves through cycles:

where major pivots form

how liquidity contracts and releases

how BTC and ETH lead rotations

how altcoins echo the structure

how wave profiles repeat across scales

Codex is not indicators.

Not magic.

Not prediction.

It is pattern recognition in practice — structure observed early enough to act.

This is not an analysis.

This is the foundation.

II. Codex Intro — Phase‑Based Publishing

I don’t publish often — only when structure shifts.

That’s the entire edge.

Codex is phase‑based, not price‑based, which is why entries often land before the market shows the outcome.

I write when the rhythm changes.

Confirmation usually comes in the days that follow.

It feels like hindsight, but it isn’t — it’s automated experience:

years of HL/LH mapping, fractals, traps, and pivots that have moved from analysis into intuition.

I recognize the phase before I can explain it.

Codex Brief is where that rhythm becomes public.

III. Case Study — Codex VIII (Macro + Primary Setups)

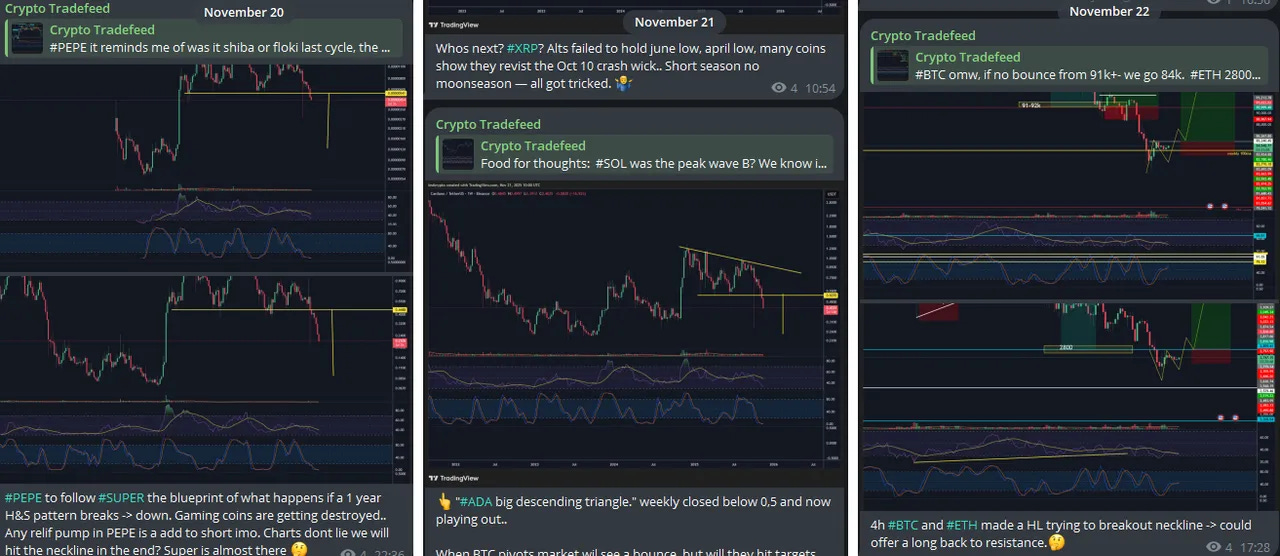

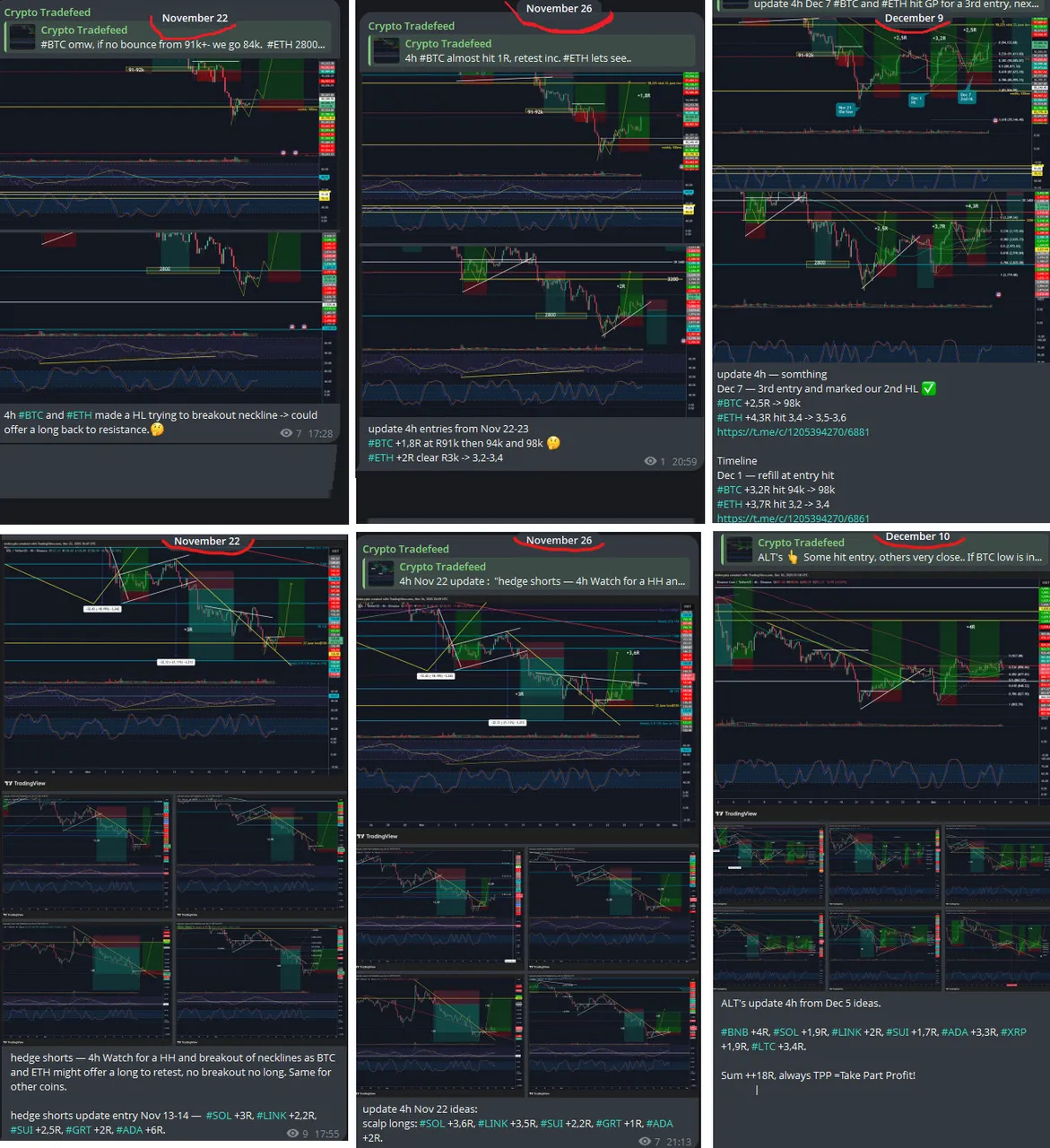

When Codex VIII was published on Nov 22, 2025, it mapped:

primary BTC bias

BTC/ETH long‑entry locations

the bounce zone for spot

the framework for the Nov–Dec move

All published before the move.

BTC printed the local bottom on Nov 21.

The HL entry was documented on Nov 22.

The structure played out step by step.

Original post (Hive, timestamped):

https://ecency.com/hive-167922/@digi-me/codex-viii-another-trick-the

This is Tier 1:

macro rhythm, structure, pivots.

Not many trades — but the right ones.

This is the rhythm Codex archives.

IV. Case Study — Follow‑Up (Edge + Echo)

The Follow‑Up revealed what Codex VIII did not include:

altcoin echoes

GP rotations

execution timing

real‑time setups

Original post (Hive, timestamped):

https://ecency.com/hive-167922/@digi-me/codex-brief-follow-up-codex

This is Tier 2 — the Edge Layer:

more setups

microstructure

scalp zones

execution logic

Deeper.

Faster.

Closer to the tape.

Where Tier 1 maps the macro rhythm,

Tier 2 shows how the rhythm expresses itself —

in echoes, rotations, and the micro‑pivots that form around the primary structure.

V. 2020–Now: Timeline of Credibility — Public Archive

Codex has had the same focus since the beginning:

find the pivot — not every candle, but every phase.

2020 → BTC bottom at $7.5k — hash‑ribbon reclaim

2021 → BTC $40k reclaim — alt expansion mapped weeks ahead

2022 → Bear‑market tracking — six bullish‑divergence bounces (+50–150%)

2023 → BTC $16k bottom — alt reversals logged pre‑consensus (+100% in ~3 months)

2024 → September reversals (+100% on multiple assets)

👉 All macro links for 2020–2024 are collected in The Final Wave:

https://ecency.com/hive-167922/@digi-me/the-final-wave-when-structure

2025 — Codex Series (Month by Month)

July 9 — The Final Wave → BTC broke out the next day

Aug 22 — ETH Speaks → ETH peaked at $4,955 two days later

Oct 2 — Uptober Begins → BTC hit $126k four days later

Nov 22 — Codex VIII → HL documented the day after the Nov 21 bottom at $80.5k

👉 All 2025 Codex posts — including silent entries — are archived in Codex VIII:

https://ecency.com/hive-167922/@digi-me/codex-viii-another-trick-the

2026 — Codex Brief on Substack

Jan/Feb — Brief 1: LH exit before wave 3 blood

(more entries will be added as the structure unfolds)

👉 All 2026 Codex Brief posts are archived on Substack:

https://codexbrief.substack.com/archive

These are not opinions.

They are timestamped posts, published before price resolved —

publicly archived on the Hive blockchain.

The archive itself is the credibility.

VI. The Codex Philosophy — Proof, Not Persuasion

I don’t sell hype.

I don’t chase followers.

I don’t care about influence.

I show the rhythm.

You see it.

You choose.

Codex works the opposite way —

proof, not persuasion.

I write before.

I revisit after.

Price confirms my memory — or proves me wrong.

Codex doesn’t chase the market.

It listens to it.

VII. The Tier Model

Codex publishes only when structure is clear —

never on a schedule.

Typically 1–3 posts per month.

Tier 1 — Macro Layer

For readers who want the big picture.

You get:

macro rhythm

BTC/ETH structure

major pivots

narrative context

1–3 key setups per month

No noise.

Only structure.

Preview:

Codex VIII — Another Trick:

https://ecency.com/hive-167922/@digi-me/codex-viii-another-trick-the

Tier 2 — Edge Layer

For traders working closer to execution.

You get:

altcoin echoes

GP rotations

scalp setups

execution notes

real entries, real outcomes

More frequent than Tier 1 —

but still structure‑driven.

Never noise.

Preview:

Codex Brief — Follow‑Up:

https://ecency.com/hive-167922/@digi-me/codex-brief-follow-up-codex

Institutional Access

Available for professional environments on request.

VIII. What Codex Is — And What It Isn’t

Codex does not provide trades.

It documents market phases.

It documents setups — it does not instruct trades.

Profits are not the product.

They are a consequence of being aligned with the right structure.

Codex is a credibility anchor —

a framework for understanding where we are in the cycle,

not a feed of calls or signals.

IX. Realistic Expectations — What Codex Actually Delivers

Codex is not a high‑frequency feed.

It is phase‑based publishing.

Tier 1 focuses on macro rhythm:

the major pivots, the structural shifts, the HL/LH zones,

the expansions and the exhaustions.

These setups appear a few times per month —

not often, but always at the right time.

Tier 2 works closer to execution:

altcoin echoes, GP rotations, scalp zones,

and the microstructure that forms around major pivots.

More frequent, but still structure‑driven — never noise.

Codex does not predict.

It documents repetition.

Pivots, not every candle.

The archive builds credibility —

one phase at a time.

X. Early Backers

As with Hive:

50% lifetime access

limited seats

no discounts later

Gratitude to those who help build this early.

⚖️ Disclaimer

Codex Brief is not financial advice.

All content is for documentation and research purposes only.