Feb 9, 2026 — Codex Brief 2 — Consolidation Is Expected. This Is Not The Floor.

February 2026 — The Weekly Fractal Confirms the C‑Phase

Short Intro

Brief 2 is not a pivot post.

It is a follow‑up — and a foreshadowing of the next phase.

Brief 1 showed the A→B wave long before it unfolded — six clean structural steps that played out while sentiment flipped back and forth for two months.

Codex didn’t predict it.

Codex recognized it.

Codex continues to timestamp structure within days.

Codex VIII mapped the bounce the day after the A‑bottom printed.

Codex Brief 1 mapped the breakdown the day before $80.5k snapped.

The rhythm hasn’t changed — structure keeps repeating.

Now the weekly fractal has repeated again — almost candle‑for‑candle — and the C‑phase is confirming exactly where the model said it would.

Brief 2 confirms the C‑wave that Codex marked as the highest‑probability path.

And just like the A→B wave had six structural setups, this phase carries its own six‑step sequence.

If you want the roadmap for the next 1–2 months, documented before it unfolds (again), you’ll find it inside.

BTC’s liquidation wick into $60k is not a bottoming pattern.

It is the first step of a larger mid‑cycle consolidation — the same trigger that initiated the C‑phase last cycle.

The key level ahead is the 200‑week MA.

A weekly close below it has marked the transition into the final phase of every major cycle.

The full structural roadmap into Week 6 — and how this consolidation typically resolves — is available in the Tier 1 section.

Ingress

The weekly structure from 2022 has now repeated almost candle‑for‑candle:

• weekly close below the 100‑week MA

• a liquidation wick the following week

• strong absorption off the wick

• and a bounce back into the body of the same weekly candle

This is the same two‑candle breakdown pattern that initiated the C‑phase last cycle.

The structure is not bottoming.

It is consolidating inside a larger wave.

The break of the A‑low at $80.5k confirmed the C‑phase two weeks ago — the same structural transition seen in 2022 after the B‑peak.

See the cover chart — the yellow box highlights the expected 5‑week consolidation window, with Week 6 marking the breakdown of the wick‑low and the transition into the next phase.

Recap — Brief 1 Played Out

Brief 1 documented the highest‑probability path: a structural break below $80.5k and a transition into the C‑phase.

That break came shortly after the brief was published, confirming the scenario Codex outlined.

The sequence that followed aligned with the model:

• break of A‑low

• acceleration into the mid‑$70s

• full liquidation wick into $60k

• absorption and bounce into the weekly candle body

The structural echo remains intact.

Wave 4 Short → C‑Phase Transition — Structural Recap

The structural short from the B‑region — documented in Brief 1 — continued to unfold exactly as mapped.

The expected Wave‑5 extension never appeared.

Instead, the structure broke down directly into the C‑phase — the same rhythm seen in 2022.

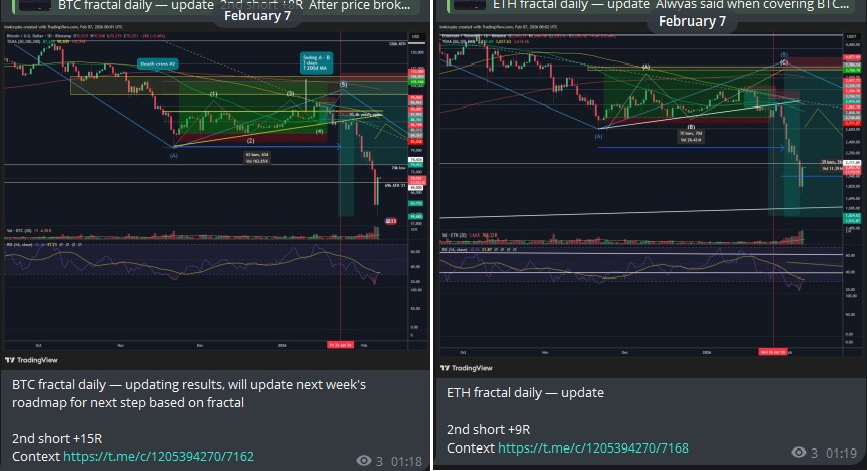

ETH mirrored the same mechanics.

BTC mapped the sequence cleanly.

ETH echoed it — exactly as logged in the journal.

Below is an excerpt from my own journal, updated Feb 7, 2026.

This is documentation — not guidance.

For readers who want to study how these structural transitions looked in real time, the archive entry “11 Silent Entries” contains multiple examples of the same mechanics across pairs:

https://ecency.com/hive-167922/@digi-me/codex-brief-11-silent-entries

(Tier 2 content — tactical structure examples)

The Weekly MA Fractal — 2022 vs 2026

2022

• Close below 100W MA

• Capitulation wick

• Bounce toward weekly candle top

• Four weeks of chop

• Higher‑low above wick

• Second capitulation → close under 200W MA

2026

• Close below 100W MA

• Capitulation wick to $59.9k

• Bounce toward weekly candle body ($75–80k window)

• Four to five weeks of consolidation

• Higher‑low above $60k (if mirrored)

• Week 6 breakdown → close under 200W MA

Same mechanics.

Same MA sequence.

New cycle.

Closing Note

Brief 2 documents the confirmation of the C‑phase — the same structural transition seen in 2022 after the B‑peak.

The wick into $60k is not a bottoming pattern.

It is the first step of a larger mid‑cycle consolidation, and the weekly MA sequence continues to repeat with precision.

The only structural invalidation for this outlook is a weekly reclaim of the 100‑week MA around $87.5k.

Unless that level is recovered, this brief outlines the most likely path forward.

Codex does not predict.

Codex records.

When the next structural pivot arrives, it will be logged — as always.

Paid Section

Active execution setups, structural checkpoints, and the full Week‑1 to Week‑6 consolidation model are available to paid members.

Stripe activation is still pending.

Early backer pledges remain open — 50% lifetime discount will stay active until paid tiers launch.

https://codexbrief.substack.com/subscribe

If you’ve already pledged and are waiting for Stripe approval, leave a comment on this post and I’ll send you the Feb 7 execution log directly.

About Codex

Codex is a timestamped research archive — a living record of structure, rhythm, and market behavior. Public posts outline the macro phases and the broader roadmaps. Paid tiers will receive the same documentation I use myself, delivered in real time as the structure unfolds: execution logs, structural setups, fractal updates, and internal notes. Screenshots shown in public Briefs are part of my own execution log — the same type of material paid tiers will access as it happens. Codex never sells signals; it documents structure.

⚖️ Disclaimer

Codex Brief is not financial advice.

All content is documentation and research — a record of structure, rhythm, and market behavior.

© 2025 Codex Research.

All content is original work. Redistribution requires permission.